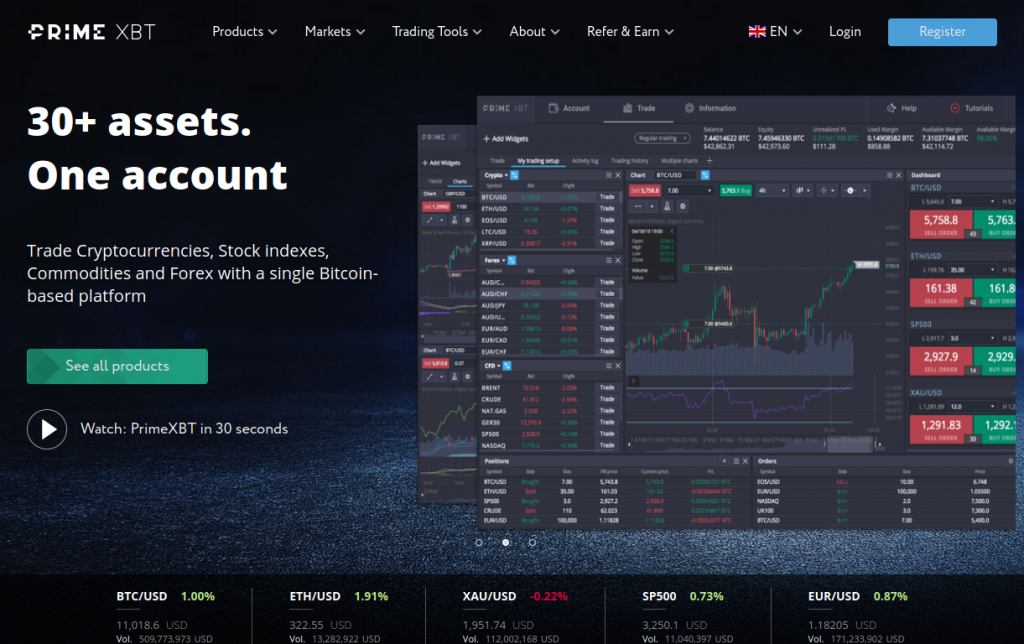

In today’s fast-paced world, many of us find ourselves asking, “how am I losing money?” It’s a crucial question that can lead to improved financial health if addressed correctly. Many individuals are unaware of the unnoticed expenditures that are quietly draining their finances. By understanding these factors and adopting a more conscious approach to spending, you can enhance your financial stability. For instance, when trading currencies or investing, it’s vital to have a reliable platform, such as how am i losing money on trades that profit primexbt PrimeXBT forex, to minimize potential losses.

Identifying Common Areas of Loss

One of the first steps in analyzing your finances is recognizing the common pitfalls that could be causing you to lose money. Here are several areas to consider:

1. Subscription Services

In the digital age, subscription services have become ubiquitous. From streaming services to gym memberships, it’s easy to overlook the cumulative cost of these monthly fees. Periodically review your subscriptions and ask yourself if you are utilizing them sufficiently. If you’re not, it might be time to cancel.

2. Impulse Purchases

Impulse buying is a well-known contributor to financial loss. The thrill of making an unplanned purchase can lead to buyer’s remorse later. Establishing a waiting period for non-essential purchases can help in curbing this tendency.

3. Dining Out

While enjoying a meal out is a delightful experience, frequent dining at restaurants can significantly affect your budget. Cooking at home is not only healthier but also much more economical. Tracking your dining expenses can shed light on how much money you’re actually spending outside.

4. Energy Bills

Another underappreciated area where money can slip away is through high energy bills. Unmonitored usage of electricity, water, and gas can result in inflated costs. Making simple changes like using energy-efficient appliances, unplugging devices when not in use, and being mindful of water usage can save a great deal in the long run.

5. Interest on Unpaid Credit Cards

Carrying a balance on credit cards is one of the most expensive mistakes consumers make. The interest rates on credit card debt are notoriously high and can lead to financial strain. It’s advisable to pay off the balance in full each month to avoid accruing interest.

Strategies to Regain Control of Your Finances

Now that you’ve identified potential areas of loss, it’s time to implement strategies that can help you regain control of your financial situation. Here are some effective methods:

1. Create a Budget

The cornerstone of financial health is a well-structured budget. By outlining your income and expenses, you can identify areas where you may be overspending. Track your finances diligently to ensure that every dollar is accounted for.

2. Use Financial Apps

Incorporating technology into your financial management can significantly streamline the process. Numerous apps are designed to help users track budgets, expenses, and even investments. Utilize these tools to keep your finances organized and in check.

3. Set Financial Goals

Having clear and achievable financial goals can motivate you to manage your money better. Whether you’re saving for a vacation, retirement, or a new car, setting specific goals can instill a sense of purpose in your spending habits.

4. Invest Wisely

Investing is a crucial aspect of financial health. However, improper investments can lead to significant losses. It’s essential to research and choose the right investment platforms and strategies that suit your financial goals. Utilizing reputable platforms like PrimeXBT forex can enhance your investment experience and assist you in making profitable trades.

Long-term Solutions for Financial Stability

Finally, achieving long-term financial stability requires a sustainable approach to money management. Here are some initiatives you can adopt:

1. Build an Emergency Fund

Life is unpredictable, and having an emergency fund can safeguard you against unforeseen expenses. Aim for at least three to six months’ worth of living expenses tucked away to steer clear of debt during emergencies.

2. Educate Yourself Financially

Invest time in learning about personal finance. Knowledge empowers you to make informed decisions regarding your money. Consider reading books, attending workshops, or following finance experts to enhance your understanding of money management.

3. Review and Adjust Regularly

Your financial situation and goals may change over time, necessitating regular reviews of your budget and strategies. Assess your financial health periodically and adjust your tactics as needed to stay on track.

Conclusion

Understanding how you are losing money is the first step towards financial improvement. By identifying leaks in your budget, implementing effective strategies, and making informed investment choices, you can regain control of your finances and work towards a more secure financial future. Remember, financial literacy and proactive management are key to ensuring that every dollar you earn works for you.