In the dynamic world of currency trading, forex trading signals Best South African Brokers play a vital role in helping traders navigate the market. Forex trading signals are essential tools for traders seeking to enhance their trading strategies and improve profitability. These signals, generated from various sources, provide insights into potential price movements in the foreign exchange market. By understanding their types, sources, and the best practices for utilizing them, traders can make informed decisions that significantly impact their trading outcomes.

Understanding Forex Trading Signals

Forex trading signals are indications, alerts, or recommendations that help traders decide when to enter or exit a trade. They can be based on technical analysis, fundamental analysis, or a combination of both. Signals can vary in complexity, from basic alerts that inform traders of potential opportunities to comprehensive reports that include in-depth analysis and predictions.

Types of Forex Trading Signals

There are several types of forex trading signals to consider, each providing different insights and advantages:

- Technical Analysis Signals: These signals are derived from price charts and are based on various technical indicators such as moving averages, RSI, MACD, and Bollinger Bands. Traders use these tools to identify patterns and trends that can indicate potential price movements.

- Fundamental Analysis Signals: These signals rely on economic news and events that can influence currency prices. Reports on interest rates, employment figures, economic growth, and geopolitical events can trigger significant market movements, and traders often use these signals to time their trades.

- Sentiment Analysis Signals: This type of signal is based on the overall mood or sentiment of the market. By gauging whether traders are feeling bullish or bearish about a particular currency, traders can use sentiment indicators to make decisions that align with prevailing trends.

Sources of Forex Trading Signals

Forex trading signals can originate from multiple sources, including:

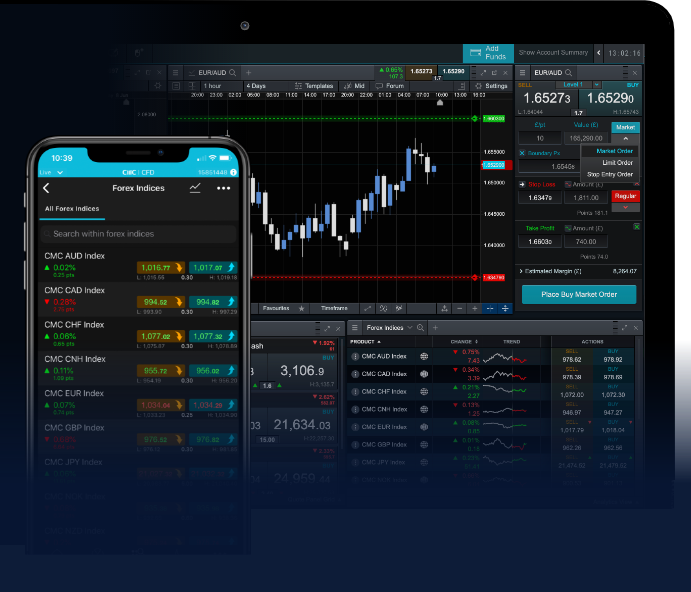

- Trading Platforms: Many trading platforms come equipped with built-in analytical tools that generate trading signals based on market data. Traders can benefit from these automated signals to make timely decisions.

- Signal Providers: A variety of companies and individuals specialize in providing forex trading signals. They analyze the market and send alerts to their subscribers, typically through email, SMS, or mobile applications.

- Social Trading Networks: These platforms allow traders to share their insights and strategies, enabling others to follow their trades in real-time. Social trading can often provide valuable trading signals from experienced traders.

The Benefits of Using Forex Trading Signals

Utilizing forex trading signals offers several advantages for traders, such as:

- Time-Saving: Analyzing the market can be time-consuming. Forex trading signals save time by providing pre-analyzed opportunities, allowing traders to focus on executing trades rather than researching every potential move.

- Improved Accuracy: Utilizing signals from experienced analysts or advanced algorithms can enhance trading accuracy. This systematic approach helps traders to make decisions grounded in data rather than emotions.

- Risk Management: Many trading signals come with risk assessments and provided entry and exit points, aiding traders in managing risk effectively. This structured approach can help avoid significant losses.

How to Effectively Use Forex Trading Signals

To maximize the benefits of forex trading signals, traders should consider the following best practices:

- Do Your Research: When selecting a signal provider or trading platform, ensure to conduct thorough research to find a reputable source that aligns with your trading style and goals.

- Combine Signals with Personal Analysis: Don’t rely solely on signals. Use them as a supplement to your analysis. Understanding the market and being aware of the broader economic context is crucial for making informed trades.

- Practice Risk Management: Always manage your risk by placing appropriate stop-loss orders and diversifying your trades. It’s important to protect your capital, especially in volatile markets.

- Keep Learning: The forex market is continuously evolving. Stay informed about new trends, techniques, and tools by engaging in ongoing education and adjusting your strategies as necessary.

Conclusion

Forex trading signals are a powerful resource for traders looking to enhance their trading strategies and improve profitability. Their ability to provide timely insights into market movements can be invaluable in a fast-paced trading environment. By understanding the various types of signals, their sources, and the best practices for using them, traders can build a robust trading strategy that increases their chances of success. As with any trading tool, the key is to combine signals with personal analysis, maintain good risk management practices, and commit to continuous learning in this dynamic market.